- Harsh Maur

- November 26, 2025

- 15 Mins read

- Scraping

How to Scrape Data from Yahoo Finance?

Scraping data from Yahoo Finance lets you automate the collection of financial information like stock prices, trading volumes, and historical data. Here's a quick guide:

- What is Web Scraping? It's a method to extract data from websites using tools or scripts.

- Why Yahoo Finance? It provides extensive financial data like real-time quotes, historical prices, and company fundamentals - all in one place.

- Legal and Ethical Considerations: Always check Yahoo's Terms of Service and adhere to their guidelines to avoid legal issues.

-

Tools You'll Need:

- Python: Programming language for scripting.

- Requests & BeautifulSoup: For static HTML scraping.

- yfinance: Simplifies data retrieval.

- Selenium: Handles dynamic, JavaScript-heavy content.

- Pandas: Organizes and processes scraped data.

Quick Steps:

-

Install required Python libraries (

requests,beautifulsoup4,yfinance, etc.). - Use yfinance for historical data or BeautifulSoup to parse static content.

- For dynamic pages, use Selenium to interact with JavaScript-rendered elements.

- Extract, clean, and structure data for analysis.

- Follow ethical scraping practices: rate-limit requests, respect Yahoo's robots.txt, and avoid overloading servers.

Legal Note: Scraping publicly accessible data is generally allowed but redistributing it could violate intellectual property laws. Always comply with Yahoo's policies.

This guide covers setup, tools, and methods for efficient and compliant data scraping.

Setting Up Your Environment

Required Tools and Libraries

Before diving into scraping Yahoo Finance, you'll need to set up a solid Python environment. Here's a rundown of the key tools and libraries that will make your work smoother:

- Python 3+: This is the backbone of your scraping setup. Python’s simplicity and extensive library support make it perfect for tasks like this.

- Requests: This library handles communication between your script and Yahoo Finance's servers. It sends HTTP GET requests to fetch raw HTML content from web pages, which is particularly handy for static content.

-

Beautiful Soup: Installed via the

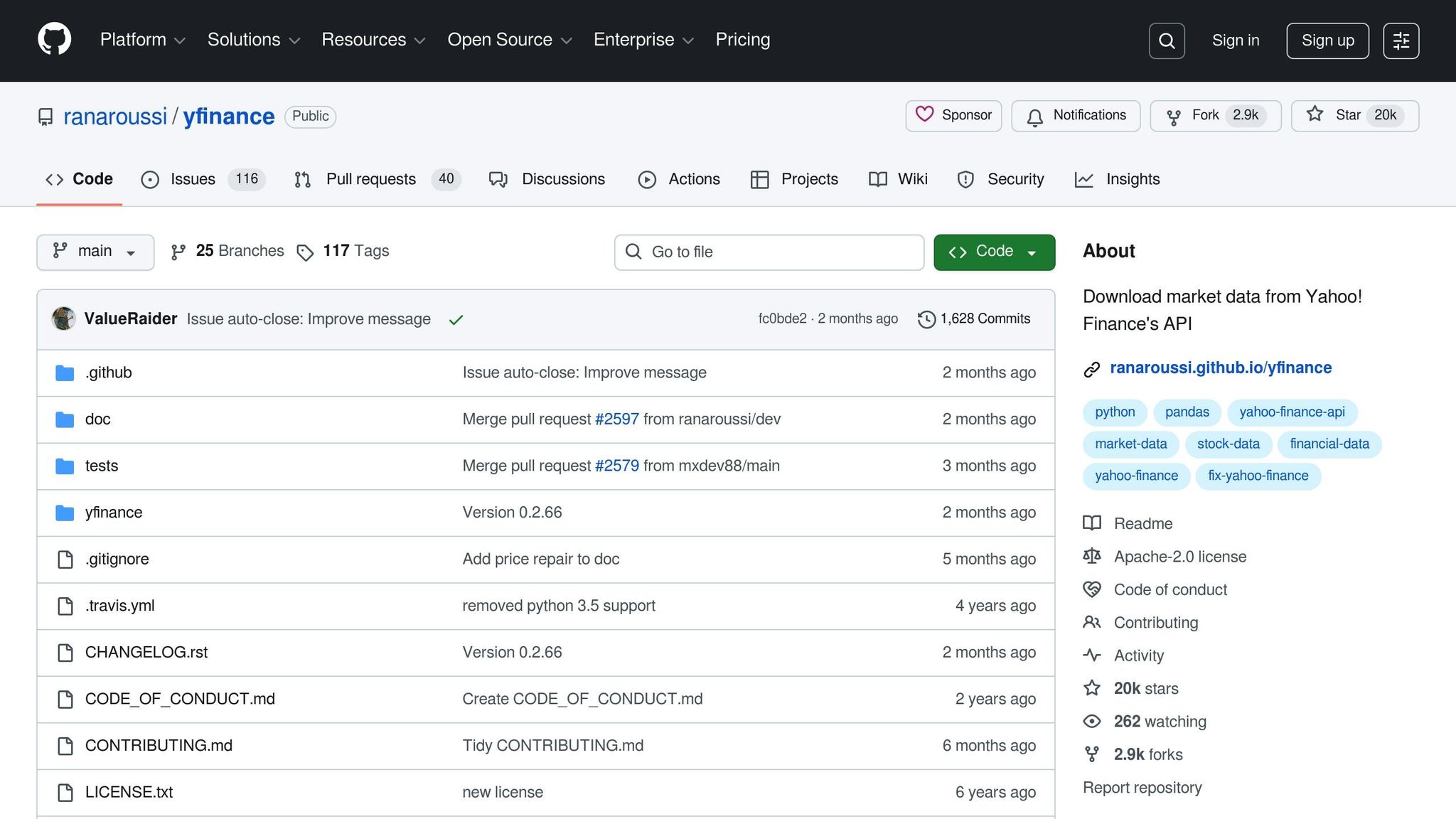

beautifulsoup4package, this tool parses the HTML content retrieved byrequests. It lets you search through the HTML using intuitive methods, making it easy to locate data like stock prices or trading volumes. For example, you can target elements by their tags, classes, or attributes - no need to wrestle with complex regular expressions. - yfinance: Unlike the manual parsing approach, this library provides direct access to Yahoo Finance's data through a Python interface. It’s designed for fetching financial metrics, historical prices, and company information. According to its GitHub page, yfinance is "intended for research and educational purposes" and is not officially affiliated with Yahoo. It simplifies tasks like retrieving data for single or multiple tickers.

- Selenium: For pages that rely heavily on JavaScript to load content, Selenium is your go-to. It programmatically controls a web browser, allowing you to render and scrape dynamic content.

- webdriver-manager: This works with Selenium to manage browser drivers automatically, sparing you the hassle of manual downloads and updates.

- Pandas: Once you've extracted financial data, Pandas helps you organize and analyze it. It structures data into DataFrames, making it easy to clean, perform calculations, or export to CSV with proper U.S. formatting (commas for thousands, periods for decimals).

Installing Python and Libraries

Setting up your environment correctly from the start can save you a lot of headaches later on. First, ensure you have Python 3 or higher installed by running python --version or python3 --version in your terminal. If it’s not installed, download the latest version from python.org.

To keep your dependencies organized, create a virtual environment. Navigate to your project directory and run:

python -m venv yahoo_scraper_env

Activate the environment with:

-

Windows:

yahoo_scraper_env\Scripts\activate -

macOS/Linux:

source yahoo_scraper_env/bin/activate

With the virtual environment active, install the necessary libraries using pip:

pip install requests beautifulsoup4 pandas

If you’re using yfinance for a simpler data retrieval process, add:

pip install yfinance

For dynamic content scraping with Selenium, install:

pip install selenium webdriver-manager

To confirm everything is installed correctly, open a Python session and try importing each library:

import requests

import bs4

import pandas

import yfinance

import selenium # Only if using Selenium

If no errors pop up, you’re good to go!

Finding Ticker Symbols and URLs

Each asset on Yahoo Finance is identified by a ticker symbol, such as "AAPL" for Apple, "AMZN" for Amazon, or "TSLA" for Tesla. To find a ticker, use the search tool on Yahoo Finance’s homepage (finance.yahoo.com). You can search for stocks, ETFs, indices, commodities, mutual funds, and even cryptocurrencies. For preferred stocks, the ticker includes "-P" with a suffix. For example, "BAC-PL" represents a Bank of America preferred stock.

Once you have a ticker, access its quote page using this URL format:

https://finance.yahoo.com/quote/{ticker_symbol}

For example, Amazon’s page would be:

https://finance.yahoo.com/quote/AMZN

Yahoo Finance also organizes data under specific paths. For instance:

-

News articles: Append

/newsto the URL, likehttps://finance.yahoo.com/quote/NVDA/newsfor NVIDIA. - Historical data: Use the JSON API, formatted like this:

https://query2.finance.yahoo.com/v8/finance/chart/{ticker}?period1={timestamp1}&period2={timestamp2}&interval=1d

Here, timestamp1 and timestamp2 represent Unix epoch times for your desired date range.

To scrape multiple stocks, create a Python list of ticker symbols, such as:

tickers = ["AAPL", "MSFT", "GOOG", "AMZN"]

Then, iterate through the list to dynamically construct URLs. Before writing your scraping code, open your browser’s developer tools (F12) and inspect the page structure. Look for unique identifiers like data-test or data-field attributes in the HTML. These will help you locate specific data points when working with BeautifulSoup.

Methods for Scraping Yahoo Finance Data

With your environment set up, it’s time to dive into the different ways you can scrape data from Yahoo Finance. Each method has its own advantages, and the best choice depends on the type of data you need and how it’s displayed on the webpage.

Scraping Static Content with Requests and BeautifulSoup

Using the combination of requests and BeautifulSoup, you can scrape static HTML content directly from Yahoo Finance. This method works well for data that doesn’t rely on JavaScript to load.

Start by importing the necessary libraries and making a simple HTTP GET request to fetch the page’s raw HTML:

import requests

from bs4 import BeautifulSoup

url = "https://finance.yahoo.com/quote/AAPL"

response = requests.get(url)

html_content = response.text

After fetching the HTML, parse it into a BeautifulSoup object:

soup = BeautifulSoup(html_content, 'html.parser')

The trick to effective scraping is understanding the page’s HTML structure. Use your browser’s developer tools (press F12) to inspect the elements containing the data you want, such as tags, classes, or attributes. Yahoo Finance often uses attributes like data-test or data-field to identify specific elements.

For instance, to extract the current stock price, you might look for a fin-streamer tag with a specific data-field attribute:

price_element = soup.find('fin-streamer', {'data-field': 'regularMarketPrice'})

current_price = price_element.text if price_element else "N/A"

print(f"Current Price: ${current_price}")

Similarly, you can extract other data points like the company name, market cap, or P/E ratio by locating their respective HTML tags:

company_name = soup.find('h1', class_='svelte-3a2v0c').text

market_cap = soup.find('fin-streamer', {'data-field': 'marketCap'}).text

pe_ratio = soup.find('td', {'data-test': 'PE_RATIO-value'}).text

Because the HTML structure can change unexpectedly, it’s a good idea to include error handling for missing elements:

try:

price = soup.find('fin-streamer', {'data-field': 'regularMarketPrice'}).text

except AttributeError:

price = "Data not found"

If you’re scraping data for multiple stocks, loop through a list of tickers and dynamically construct their URLs. Add a small delay between requests to avoid overwhelming Yahoo’s servers:

import time

tickers = ["AAPL", "MSFT", "GOOGL"]

for ticker in tickers:

url = f"https://finance.yahoo.com/quote/{ticker}"

response = requests.get(url)

soup = BeautifulSoup(response.text, 'html.parser')

# Extract data here

time.sleep(2) # Pause for 2 seconds

Using the yfinance Library for Historical Data

The yfinance library simplifies the process of retrieving historical data from Yahoo Finance. Unlike manual HTML parsing, yfinance offers a clean Python interface that outputs data in Pandas DataFrames, making it perfect for analysis.

Although Yahoo Finance officially discontinued its API in 2017, yfinance works by reverse-engineering Yahoo's publicly available data sources. However, it’s worth noting that yfinance is not officially affiliated with Yahoo and may stop working if Yahoo changes its data structure.

To get started, import yfinance and create a Ticker object for the stock you’re interested in:

import yfinance as yf

meta = yf.Ticker("META")

You can fetch historical data using the .history() method. For example, to retrieve the maximum available data:

data = meta.history(period="max")

print(data.head())

For shorter timeframes, you can specify a period like "1mo" for one month:

apple = yf.Ticker("AAPL")

data = apple.history(period="1mo")

If you need data for a custom date range, provide start and end parameters:

import datetime

start_date = datetime.datetime(2019, 5, 31)

end_date = datetime.datetime(2024, 5, 31)

amazon = yf.Ticker("AMZN")

historical_data = amazon.history(start=start_date, end=end_date)

The resulting DataFrame includes columns like Open, High, Low, Close, Volume, and more. Beyond historical prices, yfinance can also retrieve detailed company information:

# Get company info

info = meta.info

print(f"Market Cap: ${info['marketCap']:,}")

print(f"P/E Ratio: {info['trailingPE']:.2f}")

# Get financial statements

income_stmt = meta.financials

balance_sheet = meta.balance_sheet

cash_flow = meta.cashflow

For scraping data across multiple stocks, pass a list of tickers to the download() function:

tickers_list = ["AAPL", "MSFT", "GOOGL", "AMZN"]

data = yf.download(tickers_list, start="2024-01-01", end="2024-12-31")

This method is faster than making individual requests and ensures data alignment across all stocks.

Handling Dynamic Content with Selenium

Some Yahoo Finance pages use JavaScript to load data dynamically, meaning the information isn’t present in the initial HTML response. In these cases, static scraping methods like BeautifulSoup won’t work, but Selenium can handle it.

Selenium acts as a real web browser, executing JavaScript and rendering pages as a user would. While slower than other methods, it’s the most reliable option for dynamic content.

Start by setting up Selenium with a WebDriver. Use webdriver-manager for automatic driver management:

from selenium import webdriver

from selenium.webdriver.chrome.service import Service

from webdriver_manager.chrome import ChromeDriverManager

from selenium.webdriver.common.by import By

from selenium.webdriver.support.ui import WebDriverWait

from selenium.webdriver.support import expected_conditions as EC

driver = webdriver.Chrome(service=Service(ChromeDriverManager().install()))

Navigate to the desired Yahoo Finance page and wait for the dynamic content to load:

url = "https://finance.yahoo.com/quote/NVDA"

driver.get(url)

# Wait for the price element to appear

wait = WebDriverWait(driver, 10)

price_element = wait.until(

EC.presence_of_element_located((By.CSS_SELECTOR, 'fin-streamer[data-field="regularMarketPrice"]'))

)

current_price = price_element.text

print(f"NVIDIA Price: ${current_price}")

Selenium can also handle actions like scrolling or clicking to load additional data:

# Scroll down to load more content

driver.execute_script("window.scrollTo(0, document.body.scrollHeight);")

time.sleep(3) # Wait for content to load

# Click a tab to reveal more data

tab = driver.find_element(By.LINK_TEXT, "Statistics")

tab.click()

time.sleep(2)

When using Selenium, mimic human browsing behavior by adding delays between actions to reduce the risk of being blocked by Yahoo Finance’s servers.

Extracting and Processing Financial Data

Once you've scraped data from Yahoo Finance, the next step is transforming that raw information into a structured format suitable for analysis. This involves pulling out specific metrics, cleaning inconsistencies, and formatting everything to align with U.S. standards.

Extracting Key Financial Metrics

Using the scraping techniques discussed earlier, focus on extracting only the most essential financial metrics. These include stock prices, previous close, volume, and market capitalization. Here's an example of how you can achieve this:

import requests

from bs4 import BeautifulSoup

url = "https://finance.yahoo.com/quote/TSLA"

response = requests.get(url)

soup = BeautifulSoup(response.text, 'html.parser')

# Extract multiple metrics at once

metrics = {}

metrics['current_price'] = soup.find('fin-streamer', {'data-field': 'regularMarketPrice'}).text

metrics['previous_close'] = soup.find('fin-streamer', {'data-field': 'regularMarketPreviousClose'}).text

metrics['volume'] = soup.find('fin-streamer', {'data-field': 'regularMarketVolume'}).text

metrics['market_cap'] = soup.find('fin-streamer', {'data-field': 'marketCap'}).text

print(metrics)

Scraped data often comes in shorthand formats, like "1.23T" for trillions or "456.78B" for billions, and volume figures may include commas. To make this data usable, you can parse these strings into numeric values:

def parse_market_cap(cap_string):

"""Convert market cap string to numeric value."""

cap_string = cap_string.strip()

if cap_string.endswith('T'):

return float(cap_string[:-1]) * 1_000_000_000_000

elif cap_string.endswith('B'):

return float(cap_string[:-1]) * 1_000_000_000

elif cap_string.endswith('M'):

return float(cap_string[:-1]) * 1_000_000

return float(cap_string.replace(',', ''))

def parse_volume(volume_string):

"""Remove commas from volume numbers."""

return int(volume_string.replace(',', ''))

# Apply parsing functions

metrics['market_cap_numeric'] = parse_market_cap(metrics['market_cap'])

metrics['volume_numeric'] = parse_volume(metrics['volume'])

Alternatively, when using Python's yfinance library, the data is already structured in a Pandas DataFrame, which simplifies the process:

import yfinance as yf

ticker = yf.Ticker("JPM")

hist = ticker.history(period="1mo")

# Extract specific columns

closing_prices = hist['Close']

trading_volumes = hist['Volume']

high_prices = hist['High']

low_prices = hist['Low']

# Calculate additional metrics

daily_returns = hist['Close'].pct_change()

average_volume = hist['Volume'].mean()

price_range = hist['High'] - hist['Low']

For more detailed insights, pull data directly from company financial statements:

ticker = yf.Ticker("AAPL")

info = ticker.info

# Extract key financial metrics

financial_data = {

'company_name': info.get('longName', 'N/A'),

'sector': info.get('sector', 'N/A'),

'market_cap': info.get('marketCap', 0),

'pe_ratio': info.get('trailingPE', 0),

'dividend_yield': info.get('dividendYield', 0),

'profit_margin': info.get('profitMargins', 0),

'revenue': info.get('totalRevenue', 0),

'earnings_per_share': info.get('trailingEps', 0)

}

Once you've gathered the necessary metrics, it's time to clean and organize your dataset.

Cleaning and Structuring Data

Raw data from Yahoo Finance often has inconsistencies or missing values, so cleaning and standardizing it is crucial before analysis.

First, handle missing or null values:

import pandas as pd

import numpy as np

# Create DataFrame from scraped data

df = pd.DataFrame([financial_data])

# Check for missing values

print(df.isnull().sum())

# Replace missing numeric values with NaN

df['pe_ratio'] = df['pe_ratio'].replace(0, np.nan)

# Fill missing string values

df['sector'] = df['sector'].fillna('Unknown')

For historical data, you might encounter duplicate entries or gaps from non-trading days. Address these issues as follows:

# Remove duplicate rows

hist = hist[~hist.index.duplicated(keep='first')]

# Remove rows with all NaN values

hist = hist.dropna(how='all')

# Forward fill missing values

hist = hist.fillna(method='ffill')

Ensure your data types are correct, as scraped data often comes as strings:

# Convert string prices to float

df['current_price'] = pd.to_numeric(df['current_price'], errors='coerce')

# Convert volume to integer

df['volume'] = pd.to_numeric(df['volume'], errors='coerce').astype('Int64')

# Convert percentage strings to decimals

if 'change_percent' in df.columns:

df['change_percent'] = df['change_percent'].str.rstrip('%').astype('float') / 100

If you're working with multiple stocks, compile their data into a single DataFrame:

all_stocks = []

tickers = ['AAPL', 'MSFT', 'GOOGL', 'AMZN']

for ticker_symbol in tickers:

ticker = yf.Ticker(ticker_symbol)

info = ticker.info

stock_data = {

'ticker': ticker_symbol,

'company': info.get('longName', 'N/A'),

'price': info.get('currentPrice', 0),

'market_cap': info.get('marketCap', 0),

'pe_ratio': info.get('trailingPE', 0),

'volume': info.get('volume', 0)

}

all_stocks.append(stock_data)

# Create unified DataFrame

stocks_df = pd.DataFrame(all_stocks)

For time series data, ensure the date index is properly formatted:

# Reset index to convert the date index to a column

hist_reset = hist.reset_index()

# Ensure the date column is datetime type

hist_reset['Date'] = pd.to_datetime(hist_reset['Date'])

# Sort by date

hist_reset = hist_reset.sort_values('Date')

Exporting Data in U.S. Formats

After cleaning and structuring your data, export it in formats that align with U.S. standards. Start by exporting the cleaned DataFrame as a CSV file:

# Basic CSV export for current stock data

stocks_df.to_csv('yahoo_finance_data.csv', index=False)

For historical data, ensure dates are formatted as MM/DD/YYYY:

# Export historical data with U.S. date format

hist_reset['Date'] = hist_reset['Date'].dt.strftime('%m/%d/%Y')

hist_reset.to_csv('historical_prices.csv', index=False)

Finally, format currency values with dollar signs and commas for readability:

# Format currency values

stocks_df['price_formatted'] = stocks_df['price'].apply(lambda x: f"${x:,.2f}")

stocks_df['market_cap_formatted'] = stocks_df['market_cap'].apply(lambda x: f"${x:,.2f}")

These steps ensure your data is clean, standardized, and ready for analysis or reporting.

sbb-itb-65bdb53

Best Practices and Advanced Techniques

Scraping data from Yahoo Finance can be incredibly useful, but it’s important to do it responsibly and efficiently while staying within legal boundaries. Below, we’ll explore strategies and techniques to help you extract data effectively.

Best Practices for Scraping Yahoo Finance

When you’re scraping Yahoo Finance, it’s crucial to follow best practices to ensure smooth operations and avoid being blocked. One of the most important steps is to control your request rate. Sending too many requests too quickly can trigger Yahoo’s automated defenses, potentially blocking your IP address.

Here’s how you can implement rate limiting by adding delays between requests:

import time

import requests

from bs4 import BeautifulSoup

tickers = ['AAPL', 'MSFT', 'GOOGL', 'AMZN', 'TSLA']

for ticker in tickers:

url = f"https://finance.yahoo.com/quote/{ticker}"

response = requests.get(url)

soup = BeautifulSoup(response.text, 'html.parser')

time.sleep(2) # Add a 2-second delay between requests

For scenarios where requests fail, consider using exponential backoff, which increases wait times after each failed attempt. This method helps manage retries without overwhelming the server:

import time

import requests

def fetch_with_backoff(url, max_retries=5):

"""Fetch URL with exponential backoff on failure."""

for attempt in range(max_retries):

try:

response = requests.get(url, timeout=10)

if response.status_code == 200:

return response

elif response.status_code == 429: # Too many requests

wait_time = (2 ** attempt) + 1

time.sleep(wait_time)

except requests.exceptions.RequestException as e:

print(f"Attempt {attempt + 1} failed: {e}")

time.sleep(2 ** attempt)

return None

Efficient session management is another key practice. Using a session object and rotating user-agent strings can help mimic different browsers, making your scraper less likely to be detected:

import random

import requests

user_agents = [

'Mozilla/5.0 (Windows NT 10.0; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/120.0.0.0 Safari/537.36',

'Mozilla/5.0 (Macintosh; Intel Mac OS X 10_15_7) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/120.0.0.0 Safari/537.36',

'Mozilla/5.0 (Windows NT 10.0; Win64; x64; rv:121.0) Gecko/20100101 Firefox/121.0',

'Mozilla/5.0 (Macintosh; Intel Mac OS X 10_15_7) AppleWebKit/605.1.15 (KHTML, like Gecko) Version/17.1 Safari/605.1.15'

]

session = requests.Session()

session.headers.update({

'User-Agent': random.choice(user_agents),

'Accept': 'text/html,application/xhtml+xml,application/xml;q=0.9,*/*;q=0.8',

'Accept-Language': 'en-US,en;q=0.5',

'Accept-Encoding': 'gzip, deflate',

'Connection': 'keep-alive',

})

for ticker in ['AAPL', 'MSFT', 'GOOGL']:

url = f"https://finance.yahoo.com/quote/{ticker}"

response = session.get(url)

time.sleep(2)

Adding proper error handling ensures your scraper can handle unexpected issues without crashing. For example, you can log errors and handle specific exceptions:

import logging

from bs4 import BeautifulSoup

import requests

logging.basicConfig(level=logging.INFO, format='%(asctime)s - %(levelname)s - %(message)s')

def safe_scrape_ticker(ticker):

"""Scrape ticker data with comprehensive error handling."""

try:

url = f"https://finance.yahoo.com/quote/{ticker}"

response = requests.get(url, timeout=10)

response.raise_for_status()

soup = BeautifulSoup(response.text, 'html.parser')

price = soup.find('fin-streamer', {'data-field': 'regularMarketPrice'})

if price:

logging.info(f"Successfully scraped {ticker}: ${price.text}")

return price.text

else:

logging.warning(f"Price element not found for {ticker}")

return None

except requests.exceptions.Timeout:

logging.error(f"Timeout error for {ticker}")

except requests.exceptions.HTTPError as e:

logging.error(f"HTTP error for {ticker}: {e}")

except Exception as e:

logging.error(f"Unexpected error for {ticker}: {e}")

return None

Legal Considerations and Additional Techniques

Before scraping, always check Yahoo Finance’s robots.txt file to understand what is allowed. For example:

from urllib.robotparser import RobotFileParser

rp = RobotFileParser()

rp.set_url("https://finance.yahoo.com/robots.txt")

rp.read()

url = "https://finance.yahoo.com/quote/AAPL"

if rp.can_fetch("*", url):

print("Scraping is allowed")

else:

print("Scraping may be restricted")

If you’re working on a large-scale project, using proxies can help distribute requests across different IPs, reducing the risk of being blocked:

proxies = {

'http': 'http://proxy1.example.com:8080',

'https': 'http://proxy1.example.com:8080',

}

response = requests.get(url, proxies=proxies)

Lastly, caching your results can save time and reduce redundant requests. By storing previously scraped data, you can avoid repeatedly fetching the same information:

import json

import os

from datetime import datetime, timedelta

def get_cached_data(ticker, cache_hours=1):

"""Retrieve cached data if it's fresh enough."""

cache_file = f"cache/{ticker}.json"

if os.path.exists(cache_file):

with open(cache_file, 'r') as f:

cached = json.load(f)

cache_time = datetime.fromisoformat(cached['timestamp'])

if datetime.now() - cache_time < timedelta(hours=cache_hours):

return cached['data']

return None

def save_to_cache(ticker, data):

"""Save scraped data to cache."""

os.makedirs('cache', exist_ok=True)

cache_file = f"cache/{ticker}.json"

with open(cache_file, 'w') as f:

json.dump({

'timestamp': datetime.now().isoformat(),

'data': data

}, f)

Web Scraping HQ for Managed Services

If managing these techniques feels overwhelming, platforms like Web Scraping HQ can simplify the process. They offer managed services that handle everything - from setup to ongoing data extraction and monitoring. This can be a great solution for businesses needing large-scale, reliable financial data without the hassle of maintaining infrastructure. These services ensure compliance and save you from dealing with the technical complexities of web scraping.

Conclusion

Summary of Methods and Tools

Scraping data from Yahoo Finance can unlock valuable insights for financial analysis. This guide has outlined several effective methods tailored to different needs and expertise levels.

The yfinance library is an excellent starting point for Python users. It connects to Yahoo Finance's unofficial API, allowing you to retrieve historical prices, company financials, key metrics, options data, and news - all without the hassle of HTML parsing. It's a quick and efficient tool for clean, structured data.

For scenarios where yfinance falls short, requests and BeautifulSoup offer a more hands-on approach for scraping static HTML content. If you're dealing with dynamic elements, like JavaScript-driven price updates or interactive charts, Selenium is the go-to tool. It uses a real browser to render pages, enabling you to interact with and extract data that only appears after JavaScript execution.

To summarize: start with yfinance for standard datasets, switch to requests and BeautifulSoup for custom static content, and rely on Selenium when dynamic content requires it. Together, these tools provide a solid foundation for extracting financial data.

Legal Compliance Reminder

Before you begin scraping, review Yahoo Finance's robots.txt file and Terms of Service. These documents outline the site's guidelines for scraping activity.

Be mindful of rate limits and adopt conservative crawling practices, including randomized intervals, to simulate regular user behavior. Only scrape the data you truly need and ensure your activities don’t strain Yahoo’s servers.

While accessing publicly available data is generally acceptable, how you use that data matters. Commercial use, redistribution, or any action that violates Yahoo's Terms of Service could result in legal consequences. If you're developing a product or service based on Yahoo Finance data, it’s wise to consult a legal expert.

Always verify the accuracy of your scraped data before making decisions or sharing insights. If you publish analysis based on the data, be transparent about your sources.

Next Steps with Web Scraping HQ

Once you've selected your tools, decide whether to build your own scraper or use a managed service for scalability. Handling IP rotation, CAPTCHA challenges, and JavaScript-rendered content can be tricky. Managed services like Web Scraping HQ simplify this process, allowing you to focus on analyzing the data.

Web Scraping HQ provides structured data in formats like JSON or CSV, along with automated quality checks and compliance monitoring. Their Standard plan starts at $449/month, while Custom plans (from $999/month) offer tailored solutions, enterprise-grade SLAs, and priority support. For many, outsourcing scraping infrastructure proves more efficient and cost-effective than building it in-house.

Whether you choose to build your own scraper or rely on a managed service, begin with clear goals for the financial data you need and how you plan to use it. By applying these methods thoughtfully, you can elevate your financial analysis while staying compliant.

FAQs

Find answers to commonly asked questions about our Data as a Service solutions, ensuring clarity and understanding of our offerings.

We offer versatile delivery options including FTP, SFTP, AWS S3, Google Cloud Storage, email, Dropbox, and Google Drive. We accommodate data formats such as CSV, JSON, JSONLines, and XML, and are open to custom delivery or format discussions to align with your project needs.

We are equipped to extract a diverse range of data from any website, while strictly adhering to legal and ethical guidelines, including compliance with Terms and Conditions, privacy, and copyright laws. Our expert teams assess legal implications and ensure best practices in web scraping for each project.

Upon receiving your project request, our solution architects promptly engage in a discovery call to comprehend your specific needs, discussing the scope, scale, data transformation, and integrations required. A tailored solution is proposed post a thorough understanding, ensuring optimal results.

Yes, You can use AI to scrape websites. Webscraping HQ’s AI website technology can handle large amounts of data extraction and collection needs. Our AI scraping API allows user to scrape up to 50000 pages one by one.

We offer inclusive support addressing coverage issues, missed deliveries, and minor site modifications, with additional support available for significant changes necessitating comprehensive spider restructuring.

Absolutely, we offer service testing with sample data from previously scraped sources. For new sources, sample data is shared post-purchase, after the commencement of development.

We provide end-to-end solutions for web content extraction, delivering structured and accurate data efficiently. For those preferring a hands-on approach, we offer user-friendly tools for self-service data extraction.

Yes, Web scraping is detectable. One of the best ways to identify web scrapers is by examining their IP address and tracking how it's behaving.

Data extraction is crucial for leveraging the wealth of information on the web, enabling businesses to gain insights, monitor market trends, assess brand health, and maintain a competitive edge. It is invaluable in diverse applications including research, news monitoring, and contract tracking.

In retail and e-commerce, data extraction is instrumental for competitor price monitoring, allowing for automated, accurate, and efficient tracking of product prices across various platforms, aiding in strategic planning and decision-making.